By developing our own software, we have created a highly efficient way of supporting you better. Even better, FreshBooks stays in sync across desktop and mobile apps so you never miss a beat. All information will be up-to-date and ready for you to review. This detailed balance report shows your total income and your total purchases, bills and expenses so you know exactly how free invoice templates for contractors profitable your business is. HMRC nudge letters are a type of “one-to-many” communication, targeting a wider audience of businesses or individuals within similar sectors. See how your business is doing every month, and have confidence in your compliance.

The Clever Software is great no matter your needs

With FreshBooks accounting software, you get a detailed breakdown of how much you have spent and where within a given time frame. FreshBooks accounting software notes the sales taxes you’ve paid and collected in any period, making calculating remittances easier than ever. With cloud-based billing software and industry-leading secure servers, you can trust that FreshBooks has your business data on lock.

Easy-to-Use Software for Accounting and Payroll

From martial arts masters to baking supremo’s our team might have a mix of interests outside of work. But there’s one thing we all have in common, we are committed to providing you with an outstanding level of customer service and online accounting excellence. Your dedicated accountant will conduct regular tax efficiency reviews to make sure your business is operating in the most tax efficient way, claiming for every possible expense. Your dedicated accountant will always be on hand to answer any questions about your business. You can contact them via email, phone or meet them in person any time you like. When you join you will get your own dedicated accountant from one of our UK-based offices, who will get to know you and your business in detail.

Easy-to-use

TWB claims that it’s best suited to help start-ups, small businesses, creatives, landlords, ecommerce sellers, limited companies, and sole traders. You’ll need to request a quote directly with TWB, as the firm doesn’t advertise income statement template for excel its pricing. This means the cost will most likely be based on the size of your business and your specific accountancy needs. If you want more than just traditional accountancy and are looking for business development and marketing tools, you might be better suited to Pearl Chartered Accountants. However, if you only want core tax and accountancy services, TWB is a great fit. Also, in comparison to other online bookkeeping software, Mazuma provides a hands-on approach to your accounting services.

- We offer a range of industry-leading compliant solutions giving you complete peace of mind when it comes to your taxes.

- We have worked with Lisa Hinton-Hill and the team at The Accountancy Partnership for over 3 years and the service…

- We offer tailored accounting solutions for you and your business.

- The best accountant for businesses in the UK is Makesworth Accountants, an award-winning firm based in London.

- Plus, accepting payment online is very secure and your clients will appreciate you being tech-savvy.

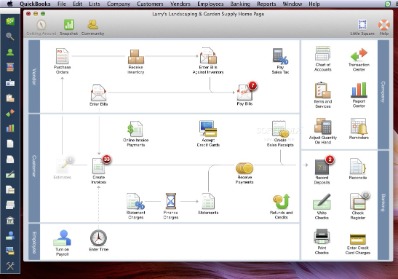

TWB (Three Wise Bears) Accountants offer accounting services, tax advice, and business forecasting. TWB uses Xero accounting software and assists when switching over if your business previously used traditional accounting solutions or a different software. The firm’s team are Xero-certified and knows how to use the software without any blips or issues. Training is offered if you or anyone in your business needs it, so you can also use Xero with ease. FreshBooks accounting software is recognized for its user-friendly interface and award-winning Support team. Have access to accurate financial data, accept online payments through our secure cloud-based accounting and speak to a real human whenever you have questions or concerns.

Accounting services costs for a small business are around £500 a year. Basic accounting services costs around £25 to £90 an hour, whereas specialist services can cost £120 to £150 an hour. Pearl also offers marketing features, such as website building and hosting, branding, and SEO. The firm will deal with designing a unit price calculator website for your business, and even manage your social media.

Live chat and email support is provided by our very own accountants and bookkeepers, so we will be guiding you every step of the way. We send regular automated email reminders to inform you of when your accounts and returns are due to be submitted, helping to ensure you never miss a deadline again. FreshBooks also provides award-winning Support to our users. Say “goodbye” to the bookkeeping methods of the past and say “hello” to an intuitive and interactive accounting solution.

Service & Software is a perfect match

Further, free accounting software options do not offer you Support when issues or emergencies occur. A paid accounting software like FreshBooks is your best option for secure and accurate invoicing and accounting. With plans built for businesses of every budget, this accounting software allows you to focus on running your business without breaking the bank. Now you can serve your clients while still having control over your finances.